Why We Believe Gold Stocks Are the Hidden Opportunity in 2024’s Bull Market

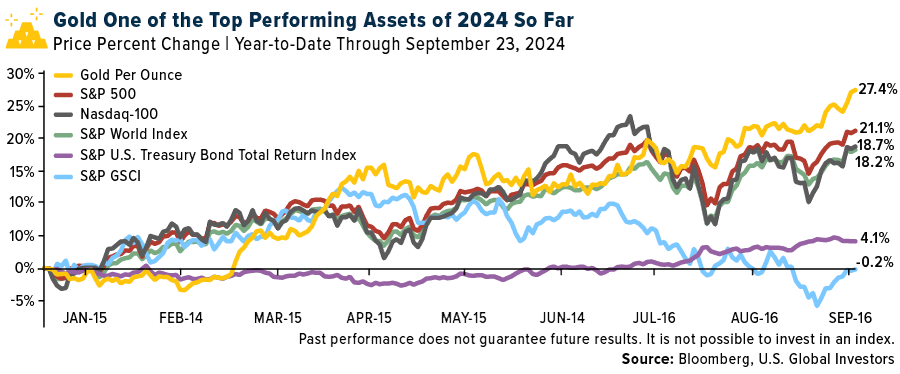

On Tuesday, gold hit a new all-time high of $2,670 an ounce, continuing a remarkable rally that’s seen the precious metal gain over 27% since the start of the year. If 2024 ended today, it would mark the best year for gold since 2010, when the asset finished up nearly 30%.

Despite the momentum, many investors still aren’t paying attention to what I consider to be one of the most obvious opportunities in the market today: gold stocks.

Some investors might be hesitant to buy into gold at these prices, but I believe there are several factors that suggest the rally still has room to run. Central banks around the world are entering a new phase of monetary easing, and investors—Western retail investors in particular—are finally starting to recognize gold’s value as a hedge against inflation and global uncertainty.

The real opportunity may not be in physical gold itself or the ETFs tracking it, though; instead, I believe it’s in the deeply undervalued gold mining stocks that have yet to catch up to the price of bullion.

Low Rates Push Investors to Consider Gold for Portfolio Diversification

At the heart of this gold rally is the Federal Reserve’s recent policy shift. The Fed made a decisive 50-basis-point (bp) rate cut last week, lowering the opportunity cost of holding a non-yielding asset like gold.

And this could be just the beginning. Analysts and market watchers expect another 50bps of easing this year, followed by an additional 100bps in 2025. This aggressive easing cycle should further increase the appeal of gold as a store of value.

The reason for this is that, when interest rates are low, investors have historically tended to move away from traditional fixed-income assets like bonds, which offer lower returns. As a result, they’ve looked for alternative investments, and gold has long been one of the most popular hedges against inflation and financial instability.

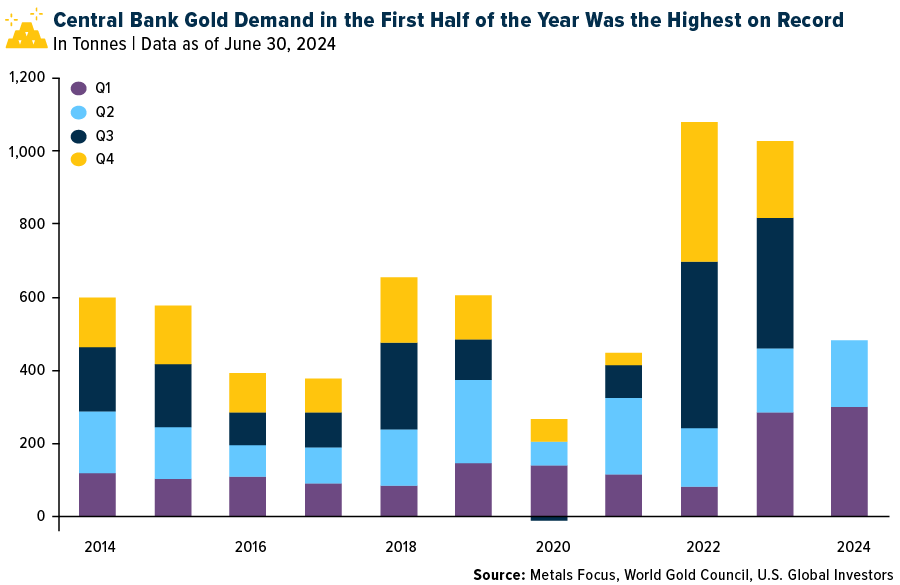

Record Central Bank Gold Purchases Fuel the Rally

It’s not just investors driving gold’s rise. Central banks are playing a massive role. In recent years, these institutions have significantly increased their gold reserves, and their buying spree shows no signs of slowing down. Central bank purchases now account for about a quarter of total global gold demand, which is double what it was before 2022. Gold-buying reached a new record high of 483 tonnes in the first half of the year, a 5% increase over the same period in 2023, according to the World Gold Council (WGC).

Despite this backdrop, many Western retail investors have been slow to embrace gold this cycles. According to a recent Bank of America study, 71% of U.S. financial advisors have little to no gold allocation, often representing less than 1% of their portfolios.

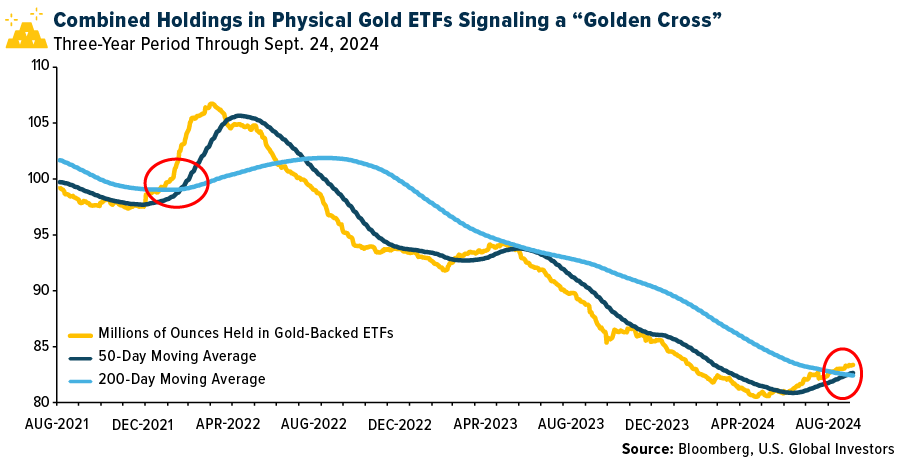

However, that narrative is changing. With the Fed’s rate cuts finally materializing, investors are starting to return to gold-backed ETFs once again. The WGC reported positive fund flows into North American gold bullion ETFs during July and August, with European products seeing similar momentum since May. For the first time since 2022, the 50-day moving average for gold holdings has crossed above its 200-day moving average, a bullish signal known as the “golden cross.” A golden cross is a chart pattern that indicates a stock’s short-term moving average (50-day) has crossed above its long-term moving average (200-day). This pattern has often been seen as a sign of a strong bull market and a potential for a major rally.

Gold Mining Stocks Remain Undervalued Despite Rising Metal Prices

While the spotlight has been on gold prices and ETFs, gold mining stocks remain highly undervalued by comparison. Over the past couple of years, shares of gold mining companies have underperformed relative to gold itself, primarily due to rising costs and a general lack of interest. In 2022 and 2023, a sharp rise in the all-in sustaining cost (AISC), a measure of the cost to produce one ounce of gold, weighed heavily on mining stocks, which in turn led to many investors losing confidence in the sector.

But here’s the thing: The underperformance of gold mining stocks relative to the underlying metal has created what I consider to be an incredible opportunity. Right now, these stocks are trading at levels that don’t reflect the continued rise in gold prices. And since gold mining stocks have typically moved out of lockstep with the broader market, they offer a level of diversification that I believe can help hedge portfolios against market downturns.

It’s not just me saying this. Some of the most well-known contrarian investors are taking note. Stanley Druckenmiller, for example, made headlines when he sold off big tech stocks like Alphabet and Amazon in late 2023 and started buying into gold miners like Newmont and Barrick.

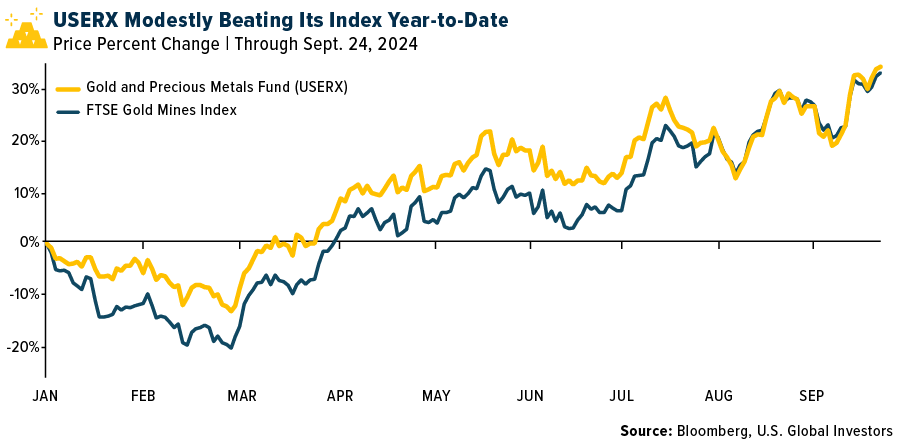

USERX Beating Its Benchmark Amid Gold’s Strong Performance

At U.S. Global Investors, we’ve always been firm believers in the potential of gold and gold mining stocks, and our Gold and Precious Metals Fund (USERX) is a reflection of that belief. As the first no-load gold fund in the U.S., USERX has a rich history of delivering value to investors through active management and a deep understanding of the mining sector.

Our investment strategy focuses on producers—companies that are currently pulling gold and other precious minerals out of the ground. These “senior” producers often have the largest market caps in the sector and are well-positioned to benefit from the ongoing rise in gold prices. Under normal market conditions, USERX invests at least 80% of its net assets in such securities.

Year-to-date, USERX is modestly beating its benchmark, the FTSE Gold Mines Index, thanks to our team’s decades of experience in both geology and mining finance. We understand the technical side of the business, and that expertise allows us to make informed investment decisions that benefit our shareholders. As gold continues its rally and central banks embark on a new easing cycle, I believe USERX is well-positioned to capitalize on the opportunities ahead.

While gold is hitting new highs, the real story could be in the undervalued gold mining stocks that many investors have overlooked. With USERX, you can tap into this potential while benefiting from the expertise of a management team that has been involved in the gold market for decades.

Ready to get started? Get your free investment kit by clicking here!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com. Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Total Annualized Returns as of 6/30/2024:

| Fund | One-Year | Five-Year | Ten-Year | Gross Expense Ratio |

|---|---|---|---|---|

| Gold and Precious Metal Fund | 17.82% | 8.08% | 4.74% | 1.60% |

| FTSE Gold Mines Index | 14.25% | 5.98% | 4.14% | n/a |

The Adviser of the Gold & Precious Metals Fund has voluntarily limited total fund operating expenses (exclusive of acquired fund fees and expenses of 0.03%, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments 0.00% to not exceed 1.90%. With the voluntary expense waiver amount of (0.00%), total annual expenses after reimbursement were 1.56%.

Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors. Diversification does not protect an investor from market risks and does not assure a profit.

The all-in sustaining cost (AISC) is a comprehensive measure that evaluates the total cost of producing an ounce of gold. It includes all the costs associated with producing gold, including operating expenses, sustaining capital expenditures, and exploration expenses. A basis point, or bp, is a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01% (0.0001).

The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable, attributable gold production of at least 300,000 ounces a year and that derive 51% or more of their revenue from mined gold. The Nasdaq-100 Index is comprised of 100 of the largest and most innovative non-financial companies listed on the Nasdaq Stock Market based on market capitalization. The S&P World Index is a stock market index that tracks the performance of large- and mid-cap stocks from 24 developed markets. The S&P U.S. Treasury Bond Index is a broad, comprehensive, market-value weighted index that seeks to measure the performance of the U.S. Treasury Bond market. The S&P GSCI is one of the most widely recognized benchmarks that is broad-based and production weighted to represent the global commodity market beta. The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Gold and Precious Metal Fund as a percentage of net assets as of 6/30/2024: Alphabet Inc. 0.00%, Amazon.com Inc. 0.00%, Newmont Corp. 0.00%, Barrick Gold Corp. 0.25%.