How the 2024 Election Could Propel Defense Stocks to New Heights

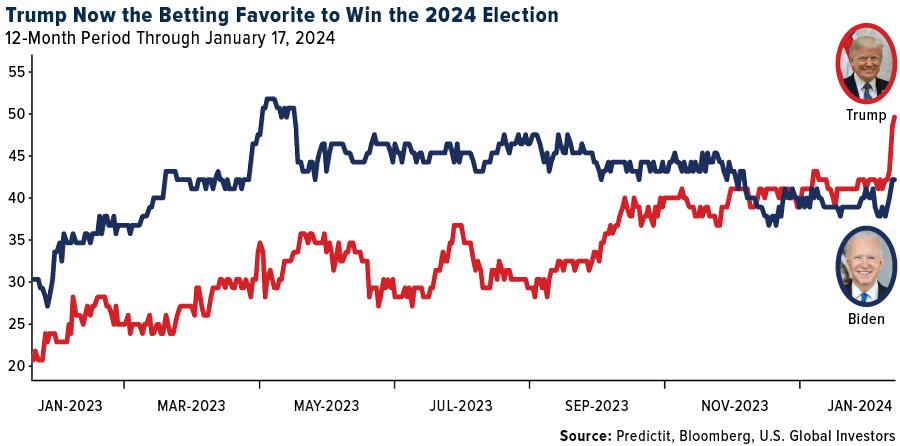

The race for the White House intensified this week as Donald Trump won the Iowa caucus with 51% of the vote, handily beating rivals Ron DeSantis and Nikki Haley. Results from the online prediction market PredictIt now show that Trump has become the betting favorite to win November’s general election.

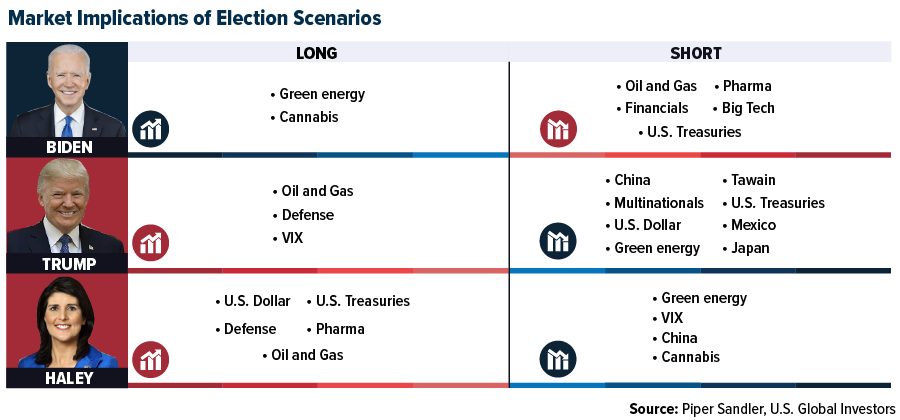

Whether you support the ex-president or not, it’s important for investors to consider the potential market ramifications of a possible second Trump term. One such sector that has come into focus is defense, especially in light of escalating tensions in the Middle East.

Trump vs. Haley’s Military Strategies

In a note to investors this week, Piper Sandler’s head of U.S. policy research, Andy Laperriere, highlighted defense as a sector to watch should Trump or Haley win in November. In fact, Laperriere gives Haley higher marks than Trump when it comes to boosting defense spending, writing that the former South Carolina governor and United Nations ambassador would be “more focused on winning substantive legislative victories in Congress than Trump.”

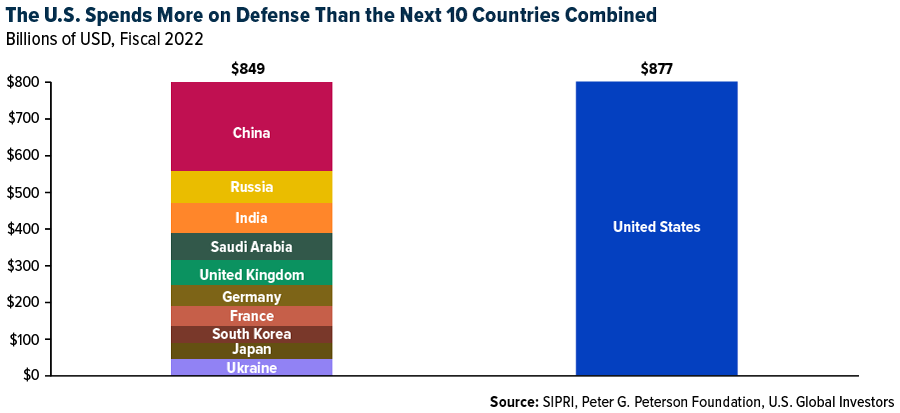

But then, a second Trump presidency might mean the U.S. pulls out of the North Atlantic Treaty Organization (NATO)—one of Trump’s longstanding priorities—in which case the U.S. would likely need to increase military outlays. The U.S. currently spends about 3.5% of its gross domestic product (GDP) on national defense, which is significantly higher than what most countries spend, but it trails the military buildup of the 1980s, when outlays were closer to 7% and 8% of GDP.

A $1 Trillion Annual Defense Budget?

None of this is to suggest that the military has languished under President Joe Biden. The U.S. already outspends the next 10 countries combined, and at the end of last year, the president signed the U.S. defense policy bill, authorizing a record $886 billion in annual military spending.

But with the world’s geopolitical thermostat climbing, it’s easy to see this budget going even higher—even topping $1 trillion. According to U.S. Under Secretary of Defense Mike McCord, that eye-watering dollar amount is “inevitable” within just a few years.

I believe this would carry clearly positive implications for defense stocks, but don’t take it from me. In December, Fitch Ratings raised its outlook of the defense industry, writing that contractors “will be supported by higher backlogs and elevated spending on national security.”

That same month, the Financial Times reviewed the orderbooks of 15 global defense contractors, finding that their combined backlogs in just the first half of 2023 totaled a massive $764 billion.

Governments’ “sustained spending” on defense “has spurred investors’ interest in the sector,” the article reads.

The “Big Five” and Federal Contracts

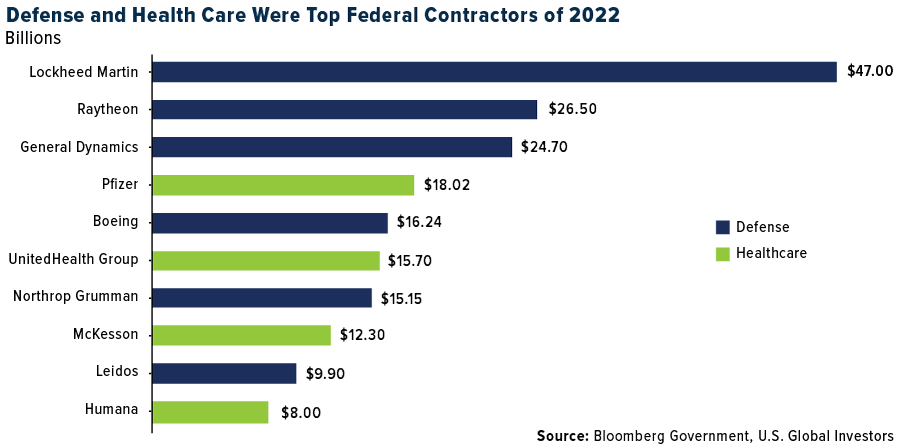

When evaluating a defense service company and its growth potential, it’s essential to spend time looking at its contract portfolio. Many of these firms have only one buyer—the federal government—which creates a unique market dynamic where competition is often less about price and more about technological and strategic superiority.

Over the years, the “Big Five” defense contractors—Lockheed Martin, RTX, General Dynamics, Boeing and Northrop Grumman—have received about a third of the Defense Department’s annual budget, according to the Congressional Research Service (CRS). 2022 saw a record $705 billion in military contracts, with $47 billion going to Lockheed Martin alone, more than any other company. In fiscal 2024’s military budget, a whopping 58 out of 78 major weapons systems—or roughly three quarters—involve at least one of the Big Five companies as a primary contractor. (In the chart below, please note that Raytheon Technologies rebranded as RTX in June 2023.)

With defense spending constituting a significant portion of the U.S. GDP and an escalating global geopolitical landscape, the 2024 election could indeed be a defining moment for defense stocks.

Investors and market observers alike are keenly watching the unfolding political developments, understanding that the election’s outcome could propel the defense sector to new financial heights.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.72%. The S&P 500 Stock Index rose 1.11%, while the Nasdaq Composite climbed 2.26%. The Russell 2000 small capitalization index lost 0.50% this week.

- The Hang Seng Composite lost 6.03% this week; while Taiwan was up 0.96% and the KOSPI fell 2.07%.

- The 10-year Treasury bond yield rose 18 basis points to 4.129%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Southwest Airlines, up 4.90%. According to JPMorgan, not a single material point raised by the court in ruling against the JetBlue/Spirit merger, directly applies to the Alaska deal to buy Hawaiian. Both of these airlines are hybrid models, as noted by the court, so the focus on preserving ultra low-cost competition does not apply.

- Container average spot rates are up 120% since December 1, with Asia-Europe spot rates up 265%. Spot rates should move higher in the coming months as the pre-Chinese New Year demand mini peak coincides with a peak in Red Sea supply disruptions.

- According to Morgan Stanley, Wizz Air agreed with the CAA in July 2023 to make several commitments regarding the handling of claims for costs incurred following flight disruptions. More than 25,000 claims were re-examined, resulting in additional payments in around 6,000 cases. £1.24m has been paid to passengers after enforcement action was taken, according to the CAA. The CAA has conducted checks on a random sample of claims and has confirmed that Wizz Air is fully compliant with the agreement.

Weaknesses

- The worst performing airline stock for the week was Wizz Air, down 9.2%. The Federal Aviation Administration (FAA) is imposing additional requirements on Boeing before its 737 Max 9 aircraft return to service. Moreover, the agency wants to review data from an initial round of docking checks on 40 planes, using Boeing’s instructions before determining whether the measurements are appropriate for the entire fleet of jets on the ground. As a result, the extra overhaul also risks prolonging the plane’s grounding for another week.

- Red Sea vessel transits are currently half of normal with containers seeing the biggest diversions, with current transits only 10% of normal. The data shows bulkers and tankers are starting to divert with Red Sea transits at 70-80% of normal levels in the past week given higher insurance. Bulk and tankers could see more diversion given the threat of Houthi retaliation after Operation Prosperity Guardian attacks last week.

- Judge William Young permanently enjoined JetBlue and Spirit from executing the proposed merger agreed on July 28, 2022, ruling that it violates the Clayton Act. The judge believed entry to backfill Spirit’s capacity is timely and likely, and he viewed it unlikely to be sufficient due to the current industry constraints (aircraft, ATC, and pilots). In turn, permitting JetBlue to acquire Sprit “would eliminate one of the airline industry’s few primary competitors that provides unique innovation and price discipline” and “the merger would likely incentivize JetBlue further to abandon its roots as a maverick, low-cost carrier.”

Opportunities

- According to JPMorgan, LCCs will continue to be a key growth engine of Asia’s aviation market.The dual-brand strategy adopted by various airlines (Cathay Pacific/HK Express, Qantas/Jetstar, etc.) has performed well as they reap synergies and concurrently capture demand for low-cost and premium leisure travel. Based on OAG estimates, the number of airport pairs operated by LCCs has increased fourfold since 2011.

- According to Stifel, Maersk and Hapag-Lloyd will form a new shipping alliance called “Gemini Cooperation” as of February 2025. The new alliance will command a combined capacity of 3.4m TEU of which Maersk will provide 60% and Hapag-Lloyd 40%. The agreement covers seven trade lanes which include the main trade lanes Far East, Transpacific and Transatlantic. It does not cover too much of the North-South trade.

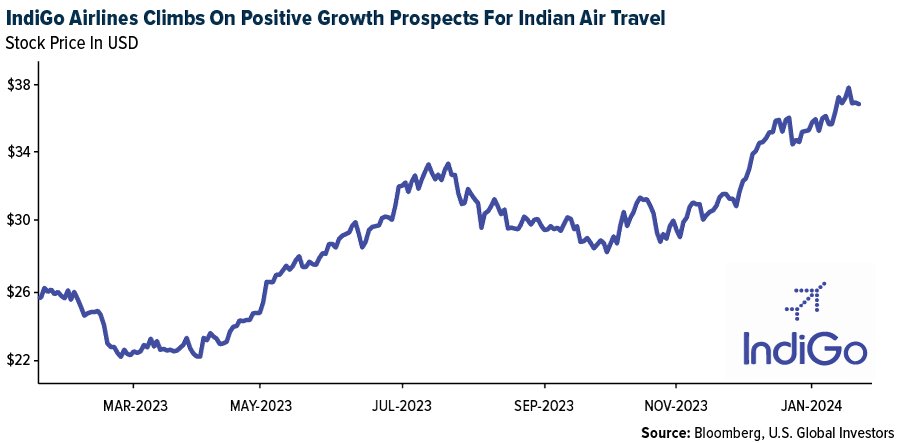

- India’s aviation market is poised to witness rapid growth, says JPMorgan, supported by higher propensity for international travel and rising disposable income. Moreover, India’s improving airport infrastructure and Indian airlines’ capacity injection (via aggressive aircraft purchases) will facilitate this growth. Currently, India accounts for the largest aircraft order backlog worldwide. This growth will require time (5-10 years) to take-off given the challenges, such as aircraft grounding, pilot shortage and infrastructure development.

Threats

- According to Folha, GOL is considering filing for Chapter 11 bankruptcy in the U.S. within a month. According to the report, over the next two weeks, the company will work on a debt restructuring plan out of court, but this seems challenging due to conflicting interests among financial creditors, aircraft lessors, and stakeholders. They state that seeking bankruptcy protection in the U.S. offers more advantages than in Brazil, citing predictable rules and more financing options.

- Reports suggest FedEx is preparing to lose half of its Express business with USPS amid their contract negotiations. In particular, 29 cities’ daytime flying was called out as being at risk of being eliminated. Altogether reports suggest that FedEx will potentially have 200 to 300 more excess pilots by October.

- According to Goldman, Copa Airlines currently operates 21 MAX 9 aircraft with seat configuration which will require further inspections once the FAA guidelines are defined. As a reference, Copa currently operates 106 aircraft and therefore, the announced grounding accounts for 20% of the company’s total capacity. Goldman notes that it currently models for Copa’s capacity to grow by 12% year-over-year in the first quarter and, as an illustrative scenario, for every week those aircraft remain grounded, the capacity forecast would be impacted by 1.5 points.

Luxury Goods and International Markets

Strengths

- Shares of Richemont gained almost 10% on Thursday. The company reported stronger-than-expected quarterly sales during the holiday shopping season, primarily due to stronger-than-expected demand for its jewelry in China and in the United States. Overall sales were strong in Japan, America, and Asia Pacific, while Europe underperformed.

- In the United States, the University of Michigan’s Consumer Survey of Sentiment showed a reading of 78.8, well ahead of the consensus for 69.5, and December’s 69.7 print. It reached its highest point since July 2021 and represents the largest two-month gain since 1991.

- Prada, a footwear and accessories retailer, was the best performing S&P Global Luxury stock, gaining 10.7% in the past five days. Equita SIM analyst Paola Carboni expects the Italian luxury fashion house to post a 16% increase in retail sales for the fourth quarter, compared with the same period a year earlier. The company benefits from its strong Miu Miu brand performance. Equita SIM upgraded Prada to a “buy” rating.

Weaknesses

- Hugo Boss posted preliminary earnings that missed analysts’ expectations. The German fashion company booked earnings before taxes of 121 million euros for the fourth quarter, up 17% on the year, but below analysts’ expectations of 133 million euros, according to estimates compiled by FactSet.

- China reported a slew of weak economic data this week, pushing global equities lower. Retail sales fell and unemployment increased. Fourth quarter gross domestic (GDP) product grew slightly below expectations. Annual GDP growth of 5.2% beat the government target of 5.0%, although it was the lowest pace of growth in more than three decades. China kept its one-year Medium-Term Landing Facility rate at 2.5%, while a cut of 10 basis points was expected by Bloomberg economists.

- Watches of Switzerland, Britain’s leading seller of Rolex, Omega, and Breitling, was the worst performing S&P Global Luxury stock, losing 37.5% in the past five days. Shares declined more than 30% in a single day of trading on Thursday, after the company announced weaker profits, predicting full-year revenue to be in the range of GBP1.53-1.55 billion, down from previous guidance of GBP1.65-1.7 billion. The operating margin is now forecasted at 8.7-8.9%, down from 10.7%.

Opportunities

- Bank of America’s luxury research team is positive on demand in the beauty industry, predicting 6% growth this year (above luxury sector growth of 4%). The broker expects the beauty segment to focus on innovation and sees dermatology growing 12% in 2024, driven by volumes. This comes thanks to distribution rollout and a customer shift toward active ingredients, functional products, and skin-based solutions.

- FactSet reports that China removed its visa requirements for 11 countries as Beijing is making efforts to open and encourage more cross-border exchanges, hoping to promote tourism and global business links. Switzerland and Ireland are the two latest additions to be granted visa-free travel into China.

- Bloomberg economists are predicting further improvement in the manufacturing and service sector in Europe. The manufacturing PMI is expected to increase from 44.4 in December to 44.8 in January. The Service PMI will likely increase from 48.8 to 49.0. The Composite PMI remains below the 50 level, which separates growth from contraction, but it has been moving in the right direction.

Threats

- China’s population fell for the second consecutive year in 2023 to 1.41 billion. Total deaths reached 11.1 million, more than an average year, while the births fell to a record low of 9.02 million from 9.56 million. The overall population decline was at a faster pace than in 2022, according to FactSet.

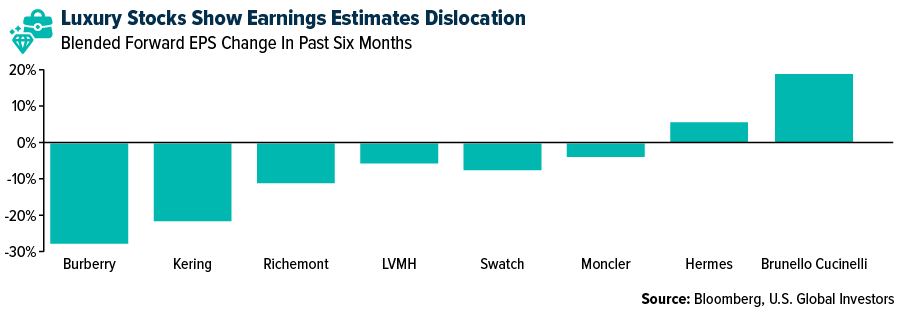

- Bloomberg reported that many brokers have scaled down their earnings expectations for luxury companies, warning that there may be a bigger performance gap between top players like Hermes and LVMH and the industry laggards. Next week, Tesla, Louis Vuitton, and Chrisitan Dior will report quarterly results.

- Approximately $49.3 billion worth of secondhand luxury products were sold worldwide in 2023, according to Bain & Company estimates. As a result, the resale market has doubled in size in four years and is now equivalent to 12% of the market value for new luxury goods, as reported by the Wall Street Journal.

Energy and Natural Resources

Strengths

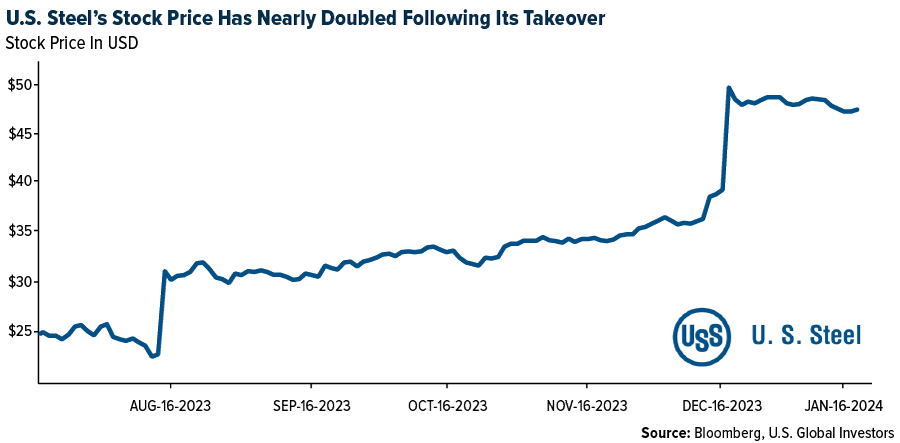

- The best performing commodity for the week was sugar, rising 9.07%, as droughts in India and Thailand threaten crops. India and Thailand are the two largest exporters of sugar after Brazil, as referenced by Bloomberg. In other news and according to Morgan Stanley, Nippon represents a very strong buyer of United States Steel Corporation, as they are technologically proficient and an advanced steelmaker. Further, Nippon is less capitally constrained than US Steel and will be able to invest more in the assets.

- According to RBC, uranium prices rose to the highest level since 2007, as supply concerns were top of mind. This came after Kazatomprom released production cuts for 2024 with risk to 2025 production targets, while the potential for U.S. sanctions on Russia may result in further disruptions to supply. On the news front, the UK announced plans to quadruple nuclear capacity to 24 GW, from 6 GW currently, with an aim to start construction on one to two new reactors every five years from 2030-2044.

- Iron ore tried to rally midweek on a report that China is considering 1 trillion yuan ($139 billion) of new debt issuance to shore up growth. The funding proposal, under discussion by senior policymakers, would involve the sale of ultra-long sovereign bonds for projects related to food, energy, supply chains and urbanization, people familiar with the matter said. However, Chinese Premier Li Qiang signaled that Beijing won’t resort to huge stimulus to shore up the property crisis.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 23.88%, despite the fridged conditions in the U.S. data released by the Energy Information Administration this week showing there is currently 11% more in storage than is typical for this time of year. First Quantum Minerals Ltd. will cut spending, pause its dividend, and put smaller mines up for sale in a sweeping effort to free up cash after it was ordered to shutter its $10 billion copper operation in Panama. The Canadian miner said Monday that it is considering a range of capital-market options to maintain its financial position and is working with banks to “address and extend” its bank loan facilities.

- Copper fell for the fourth time in five sessions, extending losses in the new year, as the latest economic data from top consumer China underwhelmed investors. Gross domestic product expanded 5.2% last year, meeting an official target of around 5%, according to data released by the National Bureau of Statistics. Industrial output in December exceeded economists’ estimates, while retail sales missed expectations and the urban jobless rate rose.

- The recent freeze across Texas and Louisiana disrupted scheduled exports of U.S. liquefied natural gas, temporarily tightening some supply of the heating and power plant fuel. The Cameron LNG export plant in Louisiana canceled at least one scheduled shipment, according to people familiar with the matter. Several other planned deliveries from Cameron and Cheniere Energy Inc.’s Corpus Christi facility in Texas were also delayed.

Opportunities

- According to Spears & Associates, offshore contract drilling will increase by 14% year-over-year, while petroleum aviation, offshore construction services, and subsea equipment are anticipated to grow annually by 12%, 10%, and 9%, respectively. Offshore projects are generally multi-year and multi-billion-dollar projects that are characterized by a large volume of reserves and a low decline rate.

- According to Scotia, among the base metals, the group continues to prefer copper exposure given very low inventories and a forecast of a near-term modest deficit to balanced market, (before transitioning to a large medium-term structural deficit due to supply erosion). Scotia also anticipates copper being among the biggest beneficiaries of global decarbonization efforts.

- Bank of America is constructive on uranium prices, currently trading at a 15-year high of $92 per pound, given an increasingly tight spot market. The bank expects the market to remain tight into 2025E when new mine supply is forecast to finally provide relief from lack of supply. With inventories evidently lower than the bank had previously believed and production slippages are a risk, the group increased its uranium price forecasts to $105 per pound (+34%) in 2024E.

Threats

- UBS cut European gas prices by 25% year-over-year in 2024 to $11/MMBTU, which implies 15% downside risk to consensus. This downward revision is driven by current inventory levels and UBS’ demand forecast, which implies relatively easy storage refill this year.

- China’s record-setting copper output is threatened by a plunge in the fees that smelters charge miners to turn ore into refined metal. Those fees have dived to the lowest level in more than two years as overseas mine disruptions reduce the amount of ore available for processing, leaving smelters to compete for what is left and reducing margins to break-even at some plants. While this is negative to the profit margins of the copper refiners, the copper miners should benefit from the more lucrative terms.

- China’s solar manufacturers are facing 2024 with concerns about overcapacity, weak profits and production shifting overseas, raising questions about one of the economy’s supposed bright spots. The country accounts for more than 90% of global solar cell production, according to Bloomberg NEF, and should remain the world’s largest solar manufacturer in 2024.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Flare, rising 29.21%.

- Global financial services company Moody’s, known for its credit ratings, said that its growing adoption of blockchain-based tokenized funds is raising the efficiency of investing in assets like government bonds and signals “untapped market potential,” writes Bloomberg.

- BlackRock’s spot Bitcoin ETF passed the $1 billion mark in investor inflows, reports Bloomberg, making it the first in the group of 11 new ETFs directly holding the cryptocurrency to surpass the milestone since the funds started trading last week.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Optimism, down 23.37%.

- Venezuela is ending its Petro cryptocurrency on Monday, more than five years after it was launched, according to multiple reports citing a message displayed on the Patria Platform, the only website where the Petro was tradeable, writes Bloomberg.

- MicroStrategy’s co-founder Michael Saylor has been selling company shares leading up to the U.S. Securities and Exchange Commission’s approval of ETFs investing directly into Bitcoin. The company’s executive chairman sold between 3,882 and 5,000 shares on certain days between January 2 and January 10 when the SEC made the announcement. It is the first time he has sold shares in nearly 12 years, writes Bloomberg.

Opportunities

- The crypto exchange Kraken is set to launch a new custody product this quarter just as U.S. ETFs investing directly into Bitcoin take off. The SEC approved almost a dozen spot Bitcoin ETFs which will need to custody billions of dollars of assets, according to Bloomberg.

- Crypto mining firm Core Scientific Inc. won court approval to exit bankruptcy and implement a restructuring plan that trims about $400 million in debt from its balance sheet and fully repays company creditors, writes Bloomberg.

- A Hong Kong financial services company aims to start an exchange-traded fund investing directly in Bitcoin this quarter as the city pushes ahead with efforts to develop a digital-asset hub, writes Bloomberg.

Threats

- FTX Founder Sam Bankman-Fried’s parents are attempting to have the lawsuit filed by the exchange against them dismissed, arguing that they were not involved in allegedly fraudulent transfers or breaches of fiduciary duties, reports Bloomberg.

- According to Bloomberg, former U.S. President Donald Trump came out against the idea of a central bank-issued digital dollar, saying he wants to “protect Americans from government tyranny.” He added, “such a currency would give our federal government absolute control over your money. They could take your money and you wouldn’t even know it is gone.”

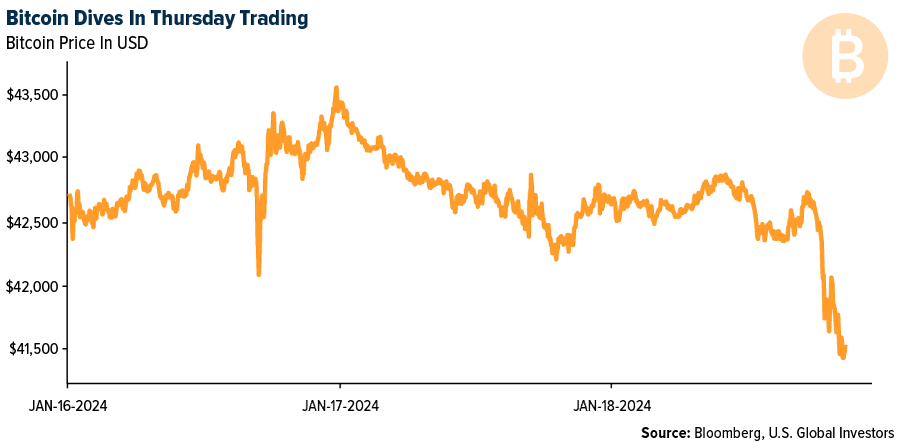

- Bitcoin dropped 2.5% to $41,500 as of noon on Thursday, following the recent hype surrounding the approval of the spot ETFs. Shares of cryptocurrency-linked stocks also fell following Bitcoin’s drop.

Gold Market

This week gold futures closed at $2,030.90, down $20.70 per ounce, or 1.01%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 6.76%. The S&P/TSX Venture Index came in off just 0.69%. The U.S. Trade-Weighted Dollar rose 0.83%.

Strengths

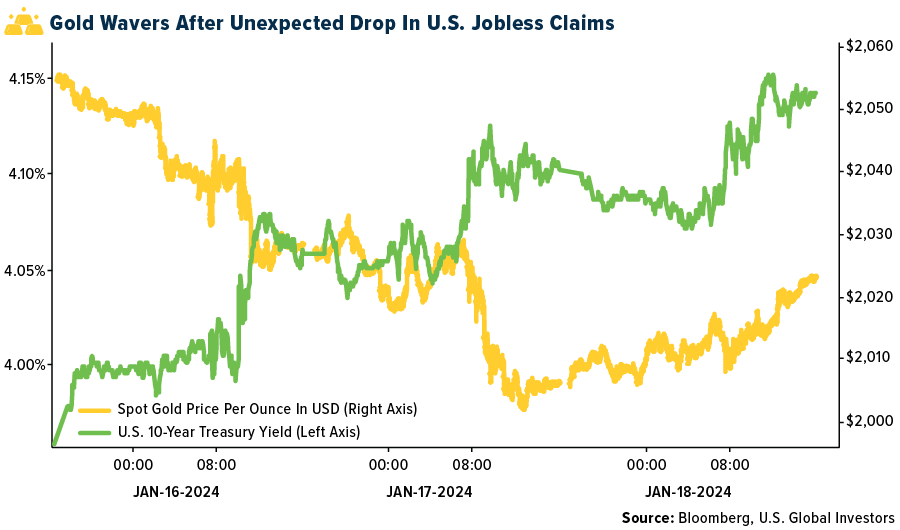

- The best performing precious metal for the week was gold, but still down 1.01%. Gold was only up by 0.09% last week yet still appears to have support above $2,000. However, the metal slipped after the dollar reached a one-month high and on increasing signs that global central banks may have to delay the timing of interest-rate cuts.

- According to Bank of America, Eldorado Gold reported fourth-quarter production results which were (surprisingly) stronger-than-expected, beating Bloomberg and Visible Alpha (VA) consensus by 6% and 2% respectively. Production was up a sizable 18% quarter-over-quarter (QoQ) also. Eldorado was one of the best performers for the week, gaining more than 3.5%

- According to Canaccord, Wesdome Gold had a strong finish to 2023 production-wise, reporting fourth-quarter gold production that beat consensus by 17%. Full-year 2023 production was slightly above the midpoint of the guidance range. Wesdome’s share price gained almost 1.75% for the week.

Weaknesses

- The worst performing precious metal for the week was palladium, down 2.81%. Palladium is still about $45 per ounce more expensive than platinum. According to Canaccord, Silvercorp Metals’ production of silver and lead were below their estimates, while gold and zinc were in line. On a silver equivalent basis, production and sales were 16% below their estimate. Lower production was driven by lower grades at the Ying mining complex, due to mine sequencing, resulting in a share price decrease of more than 5.75%

- De Beers made one of the steepest cuts to its diamond prices in years, as the world’s top producer tries to revive gem sales after the market ground to a halt. The industry almost came to a complete standstill in the second half of 2023 as the two biggest miners all but stopped supplies in a desperate attempt to stem a collapse in prices. While those efforts helped the market to pick up a bit, it is unclear how much appetite trade buyers currently have. To improve demand, De Beers cut prices by about 10% across the board at its first sale of this year.

- According to Bank of America, Pan American Silver PAAS reported Q4 silver production of 4.8Moz, 16% below Bloomberg consensus at 5.7Moz, and 16% below Visible Alpha (VA) consensus at 5.8Moz. Gold production of 267.8koz was 3% above Bloomberg consensus at 259.3koz, and 2% above Visible Alpha consensus of 263.5koz but sentiment was negative on results with their share price dropping more than 12.5% for the week.

Opportunities

- Acquisitions may be picking up. According to Scotia, Alamos Gold announced it has entered into a definitive agreement to acquire the issued and outstanding shares of Orford Mining Corporation, a $10 million small-cap exploration company. The acquisition seeks to consolidate Alamos’ existing 27.5% ownership of Orford shares through which the Company will add the highly prospective Qiqavik Gold Project, located in Quebec, Canada. Alamos took plenty of time to finally put the trigger after their first toehold purchase four and half year ago illustrating how patient Alamos was to not make a bad acquisition. Unfortunate outcome for the Orford shareholders in terms of current price levels.

- Angus Gold reported on Friday that Wesdome Gold Mine agreed to make a strategic investment in the company to purchase 10.6% of the company’s common shares and with the included warrants, Wesdome can go up to a 15% stake in the company. While Angus Gold is off the radar for many investors, it is noteworthy some of the executives and board members at Probe Gold, with solid reputations, have significant ownership interest in Angus Gold.

- Bluestone Resources was up 90% after the company announced Guatemala’s Ministry of Environment and Natural Resources (MARN) approved the environmental permit

amendment for the Cerro Blanco gold project to change the mining method from the existing permitted underground development to surface mining development.

Threats

- The value of rough lab-grown diamond imports increased by 22% YoY and 117% MoM, coming in above their three-year high and showing similar restocking trends as the rough stone market. However, polished lab-grown exports were in line with their 3-year average and fell by 19% YoY (-23% YoY), pointing to a slightly better dynamic versus polished stones.

- The speculation about rate cuts is happening as soon as March is too soon as the 2% inflation target has not been reached, European Central Bank (ECB) Governing Council member Joachim Nagel said on a panel at the World Economic Forum (WEF) in Davos. Earlier, his ECB colleague, Robert Holzmann, said that reductions in borrowing costs were not assured this year, given lingering inflation and geopolitical risks.

- According to Canaccord, Evolution Mining gold production of 161,000 ounces missed Visible Alpha consensus of 185,000, with the miss largely driven by lower production at Red Lake due to an ore pass issue at Cochenour that has now been resolved. Group cash costs of A$1,618 per ounce were due to lower sales rather than higher costs. Most analysts cut their future price target for Evolution Mining post the production miss and their share price fell nearly 17.5% for the week.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2023):

JetBlue Airways

Wizz Air Holdings

Boeing

Qantas Airways

FedEx Corp

Cheniere Energy Inc.

Richemont

LVMH

The Boeing Co.

General Dynamics Corp.

Eldorado Gold Corp.

Silvercorp Metals Inc.

Alamos Gold Inc.

Angus Gold Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.