Predicting Commodity Rallies and Energy Stock Gains Using the Global PMI

Copper is trading at a 52-week high, oil is above $90 a barrel and the S&P 500 Energy Index just hit a fresh all-time high.

Long-time readers of the Investor Alert and Frank Talk should have a good idea of why metals and energy are surging right now, but for everyone else, I have three letters for you: PMI.

We’ve shown numerous times in the past that the PMI, or purchasing managers’ index, is an effective economic leading indicator. Unlike gross domestic product (GDP), which looks in the rearview mirror, the monthly PMI gazes forward at the road ahead.

S&P Global, which produces the JPMorgan Global Manufacturing PMI, literally surveys purchasing managers from around 13,500 companies in as many as 40 countries, representing 95% of the world’s manufacturing output. It’s a remarkably thorough, comprehensive and reliable gauge of whether factories are expanding production, and by how much.

In February, the Global Manufacturing PMI turned positive for the first time since August 2022, registering a 50.3. That’s great news, but there’s more: Just a month earlier, in January, the PMI’s monthly reading crossed above its three-month moving average. This “golden cross,” as we’ve shown before, signals a higher probability that prices for copper, oil and other key materials will increase in the coming months on higher manufacturing demand.

Sure enough, here we are two months out from January’s PMI golden cross, and prices for copper and oil are surging. This, in turn, is reflected in this year’s energy equity rally, driven by major oil and gas companies Marathon Petroleum (+48% so far in 2024), Valero Energy (+41%) and Targa Resources (+33%).

All of this begs the question… Why is the Manufacturing PMI rising right now?

I think the answer to that lies in the fact that there will be a record number of elections this year, including in the U.S. In election years, it’s common for incumbent governments to introduce measures such as increased infrastructure spending, tax incentives for businesses and supportive monetary policies. These actions can lead to a surge in demand for raw materials and energy, as companies ramp up production to meet the anticipated growth in consumption.

NATO at 75: Investing in the “Pre-War Era”

NATO, the North Atlantic Treaty Organization, is commemorating its 75th anniversary this week, at a time when the 32-member alliance finds itself in an increasingly precarious position. Polish Prime Minister Donald Tusk’s warning last week that Europe has entered a “pre-war era” underscores the geopolitical challenges going forward and the need to shore up defenses.

Like it or not, the world is confronting a new age of warfare, marked by escalating conflicts (including those involving non-state actors like Hamas and the Houthis), China’s growing influence and the rapid advancement of artificial intelligence (AI) in military applications. Russia’s ongoing invasion of Ukraine has heightened concerns about spillover violence, raising questions about NATO’s long-term military support for Kyiv.

Since the alliance’s founding in 1949, the absolute number of armed conflicts globally, as well as the number of war-related deaths, has significantly declined.

But in more recent years, for reasons that will be historians’ job to unpack, hostilities have escalated. Data provided by Our World in Data shows that the total number of armed conflicts across the globe was higher in 2022 than in any year going back to 1989.

This alarming rise in violence has led to a significant surge in defense spending among NATO allies, with as many as 18 member nations expected to allocate at least 2% of their GDP to defense this year, up from just three countries in 2014, according to the group.

Europe Doubling Its Military Imports as Tensions Mount

The changing nature of warfare goes beyond conventional nation-state conflicts, with non-state actors increasingly involved in armed conflicts. The rapid development of AI and machine learning—used in autonomous weapons such as Ukraine’s Saker Scout drone—is also raising concerns about their potential use in cyber, physical and biological attacks.

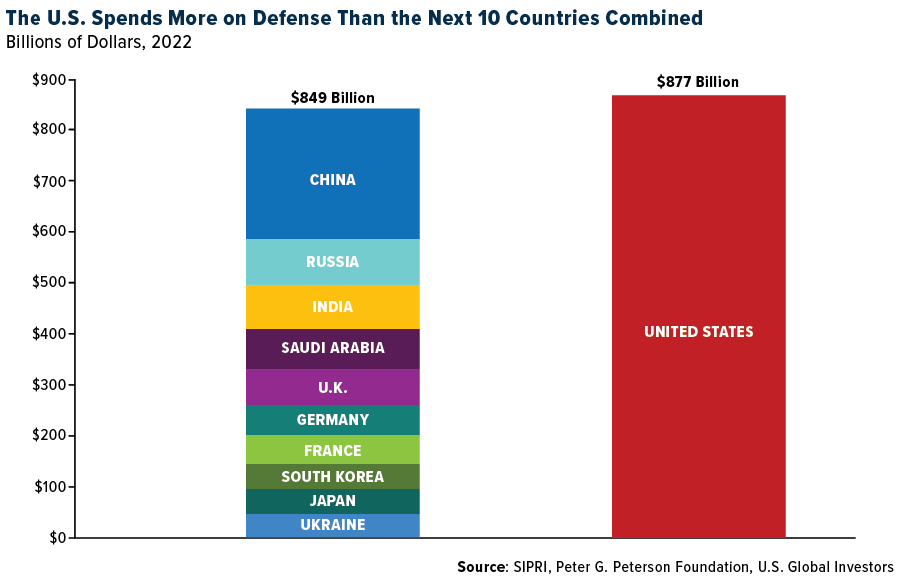

SIPRI, or the Stockholm International Peace Research Institute, reports that European states have nearly doubled their imports of major arms between 2019 and 2023, but the surge is not limited to Europe. The U.S.—which already outspends the next 10 countries combined on national defense—is closely monitoring China’s military modernization efforts. Beijing plans to boost its defense budget by 7.2% this year, focusing on developing advanced technologies such as hypersonic missiles and AI.

A Diverse Investment Landscape with Concentrated Opportunities

For investors, rising defense spending presents a compelling opportunity. In the U.S., over half of the Department of Defense (DoD) spending goes to military contractors, with the total contract spending amounting to approximately $400 billion in 2021, the most recent year of data. While this sum is distributed among thousands of contractors and subcontractors throughout the country, the “Big 5” firms—Lockheed Martin, Boeing, RTX (formerly named Raytheon), General Dynamics and Northrop Grumman—received nearly 30% of all DoD contract dollars.

Meanwhile, the list of U.S. defense industry’s AI suppliers is relatively diverse, with 300 contracts distributed among 249 unique vendors in a recent dataset. Of those, only 36 vendors were awarded multiple contracts, and just eight won three or more contracts, including major players Lockheed Martin and Northrop Grumman, according to the Center for Security and Emerging Technology (CSET). This concentration of AI contracts among a few key players suggests that these companies are well-positioned to benefit from the growing demand for innovative military solutions.

A Positive Forecast for Defense Stocks

Investing in defense stocks, like other areas, carries risks. The sector is heavily influenced by government policies, geopolitical events and public sentiment. Changes in political leadership, shifts in foreign policy and fluctuations in public support for military interventions can all impact the performance of defense stocks. The industry is subject to strict regulations and oversight, which can affect companies’ ability to secure contracts or export their products.

Despite these risks, I believe the long-term outlook for defense stocks is positive. As nations worldwide increase their military spending, companies at the forefront of defense technology and innovation are likely to benefit. The U.S. defense industry, with its strong presence in the global arms trade and its cutting-edge AI capabilities, is particularly well-positioned.

NATO has its detractors, but its role in maintaining stability has never been more vital. For astute investors, this presents a unique opportunity to capitalize on the growing demand for innovative defense technologies, particularly from major U.S. contractors.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 2.27%. The S&P 500 Stock Index fell 0.88%, while the Nasdaq Composite fell 0.80%. The Russell 2000 small capitalization index lost 2.88% this week.

- The Hang Seng Composite gained 0.68% this week; while Taiwan was up 0.95% and the KOSPI fell 1.15%.

- The 10-year Treasury bond yield rose 19 basis points to 4.397%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Trip.com, up 9.4%. Spirit Airlines completed an agreement on compensation from Pratt & Whitney regarding its GTF disk issue. The carrier expects to receive $150-200 million in compensation, well above consensus estimates.

- Raymond James’ shippers’ 12-month volume outlook for all modes came in at 2.6%, the highest level seen since the first quarter of 2022 (at the start of freight recession). Shippers are saying inventories have continued to be light and anticipate some restocking demand in coming quarters.

- Year-to-date, airlines are now up 11.4%, ahead of the S&P 500’s 10.2% gain. 2023 underperformers, Frontier and JetBlue, continue to reverse performance in 2024, up 49% and 34%, year-to-date, respectively. Network carriers Delta, United and American have also outperformed the market this year, according to Bank of America.

Weaknesses

- The worst performing airline stock for the week was Allegiant, down 13.4%. Chinese airlines saw losses in the fourth quarter of 2023, reflecting lower airfares during the off-peak travel season and higher operational costs. All Chinese airlines under JPMorgan’s coverage were loss-making in the quarter as well, with the losses averaging Rmb4.3B and attributed to a sequential easing of air travel demand, which was traditionally a noticeable trend pre-pandemic, and higher costs, (including higher fuel costs, partly due to shifts to international flights).

- FedEx announced that its contract with the USPS will not be renewed upon expiry this September. Bulls might cheer the exit of a low profitability contract but Morgan Stanley cautions against dismissing the potential decremental margin drag.

- Preliminary Boeing delivery data shows 737 deliveries of 66 compared to consensus of 80, 787 deliveries of 12 compared to consensus of 21, and 767 deliveries of three compared to consensus of six, according to Morgan Stanley.

Opportunities

- In Japan, February inbound volume was 7% above normal levels and 24% above normal excluding Chinese inbound traffic. However, Chinese inbound and Japanese outbound traffic are around 60% of normal and could take some time to reach a full recovery. The end of March/early April is likely to see strong leisure demand with Japanese school spring break and Sakura season boosting inbound tourism, according to Bank of America.

- Limited vessel traffic is expected to be restored to the port of Baltimore by the end of the month, the U.S. Army Corps of Engineers said. The USACE is planning to open a 10.66 meter (35 feet) deep and 85.34-meter-wide channel in the next four weeks and is aiming for a full reopening of the permanent channel by the end of May.

- Spirit added to summer flying, raising its capacity by 130 basis points (bps) each month from June to August, after loading schedules through November last week. Similar to the prior week, capacity adds benefited domestic flying, according to Bank of America.

Threats

- China’s March domestic yields were soft at 1% below 2019 levels while seat loads improved slightly to 81% for the month. Bank of America expects weak pricing to continue for April especially when carriers are carefully monitoring seat loads as one of the biggest movers for airline profitability.

- According to Shipping Watch, the owner of the ship that rammed into a bridge in Baltimore last week, is seeking to limit its liability to about $43.7 million. The company, Grace Ocean, could face hundreds of millions of dollars in damage claims, legal experts say. On Monday it filed a petition jointly with Synergy Marine, which was operating the Singapore-flagged cargo ship Dali. They claim the collapse of the Francis Scott Key Bridge was “not due to any fault, neglect, or want of care” of the companies and that they should not be held liable for any loss or damage from the disaster. However, if they are held liable, it should not be for more than the current value of the ship and its cargo, the companies said. Following the crash, the total value has fallen from as much as $90 million to $43.7 million, according to the filing in federal court in Maryland.

- United Airlines offers pilots voluntary, unpaid time off amidst aircraft delivery delays. According to CNBC, United’s management sent a letter to its pilots offering time off in May, and potentially through the summer, due to the recent aircraft delivery delays.

Luxury Goods and International Markets

Strengths

- Kering, parent company of Gucci, is buying a $1.41 billion property in Milan. The 18th-century building has five floors with more than 5,000 square meters of retail space. Milan’s Via Monte Napoleon houses many luxury shops and is widely considered one of the most expensive streets in the world.

- Related Group, property company, sold two penhosuses on the Fisher Island in Miami for more than $150 million, representing the two most expensive condos sold in the area. Miami has long been a destination for wealthy families, including many from Latin America, but an increasing number of Americans are moving there for the weather, low taxes, and lifestyle.

- Amorepacific Corporation, a South Korean beauty company, was the best performing S&P Global Luxury stock, gaining 10.14% in the past five days. Shares gained on expectations of strong sales and a macro recovery in China. Last weekend, China reported stronger Manufactuing PMI. China’s Manufactuing PMI crossed above the 50-mark, separating growth from contraction.

Weaknesses

- In February 2024, Eurozone retail sales experienced a 0.5% decline due to reduced demand for both food and non-food items. The largest monthly decreases in total retail trade volume were recorded in Germany (-1.9%), Belgium (-1.8%) and Greek Cypriot (-1.1%).

- Initial applications for U.S. unemployment benefits rose last week to the highest since January. Initial claims increased by 9,000 to 221,000 in the week ended March 30, according to Labor Department data released on Thursday.

- PVH was the worst performing S&P Global Luxury stock, losing 22.8% in the past five days. Shares declined after the company guided weaker sales.

Opportunities

- Morgan Stanley published a presentation promoting European luxury goods, with a focus on jewelry and watches. The broker stated that the importance of the luxury sector in the European market is increasing. Year-to-date, luxury companies account for about 8% of the total market capitalization of the STOXX 600 Index, up from 3.3% in 2013, highlighting that most of these names have generated superior returns compared to the broader market.

- Financial Times reported that the divergence between U.S. and European inflation paths and economic performance may justify earlier policy easing. In Europe, inflation has been falling faster than in U.S. while the economic performance is not as strong. Rate cuts are provided to stimulate the economy and tend to push stocks hihger.

- BMW and Tata Technologies (a subsidiary of Tata Motors, India’s largest automaker) have signed an agreement to form a joint venture company that will develop software for the German carmaker. BMW says that working with Tata Technologies will not only provide them with software engineering experience, but the location of the joint venture’s offices will allow it to run continued operations.

Threats

- PVH, the parent company of Tommy Hilfiger and Calvin Klein, reported stronger fourth-quarter earnings per share. However, the company issued a sales warning, causing shares to plummet by 22% in a single day of trading on Monday. This marked another instance of a company reporting stronger-than-expected past results but predicting a tougher macroeconomic backdrop in 2024.

- A boom seen in “tween” skin-care sales has led to a backlash from parents, as well as safety warning messages from brands telling kids not to buy their products, reports Bloomberg. The skincare and beauty industries are one of the primary sectors of the luxury market – for numerous age ranges.

- JPMorgan analyst Ryan Brinkman cut the price target for Tesla from $130 to $115. Year-to-date, Tesla shaes have dropped 31%, the worst performing stock within the S&P 500 Index.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was coffee, rising 12.20%, on increased demand as well as a subsequent short squeeze on the dealers from the funds adding to their long position, reports StoneX Financial Inc. Qatar Energy has signed four agreements to charter 19 liquefied natural gas carriers from Asian ship operators as it prepares to ramp up output. China’s CMES Co. Ltd. and Shandong Marine Group Ltd. will supply six vessels each, Qatar’s energy minister Saad Al-Kaabi said at a ceremony in Doha on Sunday.

- Iron ore reversed direction after dropping to its lowest level in 10 months as optimism that the country’s economic recovery may be starting to gain traction countered weakness in the steel market, according to Bloomberg. UBS noted that iron ore prices are now at the 95th percentile of the cost curve for producing iron ore and that should provide a floor for prices.

- Spot steel prices increased 2.5% over the past two weeks to $820 per ton, with the recent increase attributed to mills holding firm offers and showing less willingness to negotiate after announcing base spot HRC price increases in early March, according to BMO.

Weaknesses

- The worst performing commodity for the week was cotton, accelerating its downward drop in price, which began in March, by 5.61%, as news that Pakistan’s cotton yarn imports to China have exceeded $100 million mark in the first two months of 2024. Analysts believe Pakistan’s crop yields for cotton were strong this season.

- China’s copper smelters remain under pressure on a lack of mine supply, so the country is proactively managing the operating environment, with SMM reporting that five decisions were reached at a recent meeting of the China Smelter Purchasing Team. This included joint production cuts of 5-10%, according to Bank of America.

- If consumers are expecting lower prices, oil well productivity in 2023 shows a decline in 7 of 10 basins reflecting contracting production. Echoing JP Morgan’s past analysis, they have seen declines across 5 of the 7 major oil basins when looking at six-month oil production. With oil prices falling for most of 2023, that may not be a surprise, however the past two months of 2024 reflect much stronger prices, ultimately pinching the consumer.

Opportunities

- Global liquefied natural gas supplies are shifting back to Asia after a drop in prices prompted a flurry of purchases from emerging nations. Shipments to Asia rose to about 24 million tons in March, a 12% increase from last year and the highest ever for the month, according to ship-tracking figures from data intelligence company Kpler.

- Big tech may be driving the stock market, but after a blow-out first quarter, big oil would like a word, writes Bloomberg. After finishing 2023 in the red as the broader market soared, energy stocks have started 2024 with a sharp rally that has them beating tech indexes this year. Specifically, the closely watched Energy Select Sector exchange-traded fund, or XLE, is up more than 13% since the start of January while the Nasdaq 100 Index has gained just 8.7%, the article continues.

- Schlumberger (SLB) agreed to acquire rival oilfield service provider ChampionX for $7.8 billion in an all-stock deal, a move that will bulk up SLB’s portfolio as aging shale fields mean U.S. drillers need better technology to maintain oil and gas production, according to Bloomberg.

Threats

- OPEC oil output fell last month, a Reuters survey found, reflecting lower exports from Iraq and Nigeria against a backdrop of ongoing voluntary supply cuts by some members agreed with the wider OPEC+ alliance. OPEC pumped 26.42 mbpd last month, down 50,000 bpd from February.

- Russia’s oil losses could worsen as Ukraine is building a full-fledged drone industry, setting a target of producing one million drones domestically in 2024. Drone strikes have so far reached Western Russian territory within the well-established 1,200 km flying radius, where 19 refiners with a combined capacity of 3.8 mbd—more than half the Russian total—are located, according to JPMorgan.

- Investors should prepare for lower dividends from some of the most widely owned mining stocks amid wild swings in commodity prices and as companies prepare for higher capital expenditure, according to Morgan Stanley.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Core, rising 140%.

- A pair of Goldman Sachs Group and BlockTower Capital alumni have launched a new digital-asset investment firm focusing on areas including derivatives, tokenization of real-world assets, entertainment, gaming and social. Miami-based Neoclassic will invest in both private and public markets in crypto, writes Bloomberg.

- PayPal Holdings’ Xoom cross-border money transfer service now allows customers to send funds abroad using dollars converted from Paypal USD stablecoin, reports Bloomberg, the latest sign of crypto’s encroachment on international remittances.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was WormHold, down 29%.

- Lithuania, which established itself as a hub for financial-technology startups over the past decade, will weed out many of the crypto companies operating there when it starts awarding licenses next year. While some 580 crypto asset firms are registered in Lithuania, the number expected to pass the hurdle for obtaining full permits will be much lower, according to a central bank board member, writes Bloomberg.

- Sharmin Mossavar-Rahmani, CIO of Goldman Sachs wealth management, told the Wall St Journal in an interview this week that despite all the recent hype around Bitcoin ETFs, her firm isn’t buying into it, reports Bloomberg.

Opportunities

- Micheal Novogratz’s Galaxy Digital is in the early stages of raising a new venture fund, with most of its targeted $100 million expected to come from outside investors, writes Bloomberg.

- Bhutan’s investment arm and Bitdeer Technologies Group are planning to ramp up their Bitcoin mining operation to help offset the revenue impact of an upcoming event known as the Halving. The partnership between Druk Holding and Bitdeer aims to invest in boosting Bhutan’s mining capacity sixfold through the introduction of cutting-edge hardware, writes Bloomberg.

- Blockchain developer Ripple Labs plans to introduce its own dollar-denominated stablecoin, joining a long list of upstarts in a corner of crypto assets long-dominated by Tether Holdings. Ripple’s stablecoin will start trading later this year, writes Bloomberg.

Threats

- The legal and compliance head for phony cryptocurrency OneCoin was sentenced to four years in prison for her role in the $4 billion fraud scheme, becoming the latest scam participant to end up behind bars. Irina Dilkiska was sentenced in New York, according to Bloomberg.

- Bitcoin dropped the most in almost two weeks, writes Bloomberg, weighed down by cooling demand for dedicated U.S. exchange-traded funds and ebbing bets on looser Federal Reserve monetary policy. Bitcoin fell as much as 7.4%, the biggest intraday decline since March 19.

- A ratio that compares the price of Bitcoin and Ethereum hinted at a possible waning of risk appetite in crypto, reports Bloomberg. The ratio scaled 20 this week and reached the highest level since April 2021. This pattern could be a very early signal of FOMO, according to QCP capital.

Defense and Cybersecurity

Strengths

- General Dynamics and Northrop Grumman have secured spots on a $3.05 billion contract to supply the U.S. Army with medium caliber training cartridges over five years, concluding by April 4, 2029. This leverages their extensive experience in ammunition production.

- Lockheed Martin received a $483 million contract from the U.S. Army for the production of JAGM and HELLFIRE missiles, marking the third year of a potential $4.5 billion deal through 2025. This comes in support of the U.S. Navy, and international customers, with continued production and procurement for global defense.

- The best performing stock in the XAR ETF this week was General Dynamics, rising 4.49% on the back of positive sentiment surrounding recent company news.

Weaknesses

- An Israeli military airstrike in Gaza killed seven World Central Kitchen aid workers, including citizens from Poland, Australia, and Great Britain. The news marks a devastating blow to humanitarian efforts amidst escalating conflict.

- The U.S. Navy’s top acquisition program, the next-generation nuclear-armed Columbia-class submarine, is facing a significant delay of 12-16 months in its first delivery. This complicates efforts to replace the aging Ohio-class ICBM fleet amidst concerns over rising costs and broader implications for the U.S.’s nuclear modernization in the face of China’s advancements.

- The worst performing stock in the XAR ETF this week was Virgin Galactic Holdings, falling 16.22%. The Company was sued by Boeing for using trade secrets and subsequently hit a record low of $1.24 per share.

Opportunities

- Kratos Defense & Security Solutions and Shield AI announced the successful integration of Shield AI’s Hivemind AI pilot into Kratos’ unmanned aerial systems (UAS). This marks a significant step toward deploying AI-controlled aircraft in defense applications. The collaboration has led to the rapid development and flight testing of AI pilots on various aircraft, showcasing significant advancements in autonomous flight technology and the potential for wide application in military operations.

- Lockheed Martin’s F-22 Raptor, a pioneering fifth-generation stealth fighter developed to replace the U.S. Air Force’s F-15 and F-16, emerged as a significant advancement in aerial combat technology with unmatched speed, maneuverability, and stealth capabilities. However, its development and operational costs led to a reduced fleet size and questioned its practicality in modern warfare’s changing dynamics.

- Amid the ongoing war in Ukraine and its threat to Europe, Rheinmetall is constructing a significant hybrid plant in Szeged, Hungary, that will integrate its civil and defense operations. With an investment of €63 million and the creation of 300 jobs, it will enhance the region’s strategic and economic profile.

Threats

- Iran vowed retaliation against Israel for a deadly airstrike on its embassy in Syria, escalating tensions in their proxy conflict amid the Gaza war. Both sides are preparing for further confrontations and international diplomacy intensifying in response.

- The Texas attorney general is investigating Spirit AeroSystems for potentially defective aircraft parts linked to Boeing crashes and emergencies, scrutinizing the company’s DEI policies and demanding documents to ensure manufacturing standards prioritize passenger safety.

- China and Russia tested a new communication channel at a distance of 3800 km (2361 mi), that can “neither be tapped nor broken.” Satellite communications were provided by the Chinese Mo Tzu satellite, launched in 2016.

Gold Market

This week gold futures closed at $2,342.00, up $103.60 per ounce, or 4.63%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 7.11%. The S&P/TSX Venture Index came in up 3.72%. The U.S. Trade-Weighted Dollar fell 0.24%.

Strengths

- The best performing precious metal for the week was silver, up 10.35%. Gold, and in particular, silver, had a buoyant week, climbing higher on Friday despite the surge in nonfarm payrolls. One would expect the release to temper gold back, as it will be longer before any rate cuts materialize now. Instead, gold continued to push higher, likely on more geopolitical risk as Iran tells the U.S. to step aside as it readies a response to Israel’s attack on its consulate in Syria.

- IAMGOLD reported first gold was poured at Côté, on schedule. BMO thinks this milestone is an accomplishment worth celebrating at the project. In other news, Gold Fields announced the delivery of first gold from its Salares Norte project in Chile, in line with its revised project schedule, according to BMO.

- RBC expects a modest positive reaction from K92 Mining shares following the release of fourth quarter financial results, which came in ahead of estimates and consensus on lower costs. On Friday, National Bank raised its price target on K92 Mining to C$9.00 from $8.50. Stifel took its price target C$11.00 from C$10.00 on Wednesday.

Weaknesses

- The worst performing precious metal for the week was palladium, down 1.22% as hedge funds boosted their net-bearish position to a four-week high. For the first quarter of 2024, the gold price was strong, primarily driven by dovish signaling from central banks, escalating geopolitical tensions, and falling real rates. Despite bullion’s strength, the gold equities lagged, primarily driven by guidance misses, cost inflation, jurisdictional impacts, and dividend cuts, among other factors, according to Bank of America.

- Gold Fields’ production for the first quarter of 2024 is expected to be lower than planned because of operational challenges at the South Deep mine and weather-related events in Australia and Peru, according to Bloomberg.

- Westgold Resources has reported March quarter-end production of 52.1koz, a miss versus Canaccord’s forecast of 64koz and down 12% quarter-over-quarter, following heavy rainfall that interrupted operations at both Murchison and Bryah last month.

Opportunities

- The S&P/TSX Gold Index (in U.S. dollar terms) was up 19% in March, its best monthly performance in almost four years; the GDX ETF was up 20%. While strong, Canaccord continues to view the sector as undervalued. Based on the ratio of gold to the S&P/TSX Gold Index (in USD), Canaccord sees 25% upside to the average. The chart below shows the performance of the S&P Venture Precious Metals & Minerals Index of junior gold exploration stocks, which surged 27% in March, outperforming its senior peers. This is a move we have not seen happen in several years, meaning money is moving back into junior mining again.

- According to Barron’s, stocks, bonds and cryptocurrencies all slumped while stalwart old gold continued its remarkable rally, with a sixth day of gains and another record high. Over the past six months, the correlation between Bitcoin and gold is very low at 7.2% — a 100% link would denote the two assets trade in sync.

- Central banks themselves keep adding gold to their portfolios. This has perhaps been most visible in China, where the PBOC has been increasing its exposure. That buying has also attracted purchases from China’s retail market participants. Indeed, jewelry sales and non-monetary gold imports hit record highs earlier this year, according to Bank of America.

Threats

- In aggregate, gold miners slashed exploration budgets in 2024 with guidance implying a 9% decline from 2023. In Bank of America’s view, this trend can be attributed to rising costs that have eroded margins. Exploration is typically the easiest item to cut, owing to its non-operational nature. This may set the stage for more acquisitions in 2024 with less spending.

- Gold has gone past not only its nominal record, but also its previous inflation-adjusted highs. While fundamentals are supportive, it may be getting slightly ahead of itself over the short term, according to Bloomberg.

- Several gold miners have already flagged production impacts from rainfall disruptions. Tracking rainfall around select Australian gold assets highlights that other assets are likely impacted to varying degrees, where Goldman has adjusted its quarterly production for rain at Jundee and Carosue Dam/Kal (Northern Star), along with Mt. Rawdon and Mungari (Evolution Mining).

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2024):

Frontier Group Holdings

JetBlue Airways Corp.

Delta Air Lines

United Airlines

American Airlines

FedEx Corp

Boeing

Schlumberger

Marathon Petroleum Corp.

Valero Energy Corp.

The Boeing Co.

General Dynamics Corp.

K92 Mining

IAMGOLD

WestGold Resources

Kering SA

Tesla Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd.