Short-Term Treasury and Municipal Bond Funds in a High-Interest Rate Environment

Currently above 5%, the two-year yield is even significantly above the S&P 500’s dividend yield of around 1.6%—the greatest such difference in over 20 years.

With interest rates at multiyear highs, it may be appropriate right now for investors to consider investing in U.S. Treasuries and municipal bonds with shorter maturities between one and five years. Historically, such bonds have been less sensitive to the vagaries of the Federal Reserve and its aggressive rate-hiking scheme.

The Fed’s hawkish approach has kept short-end yields high, with the yield on the two-year Treasury surpassing that of the 10-year bond by about half a percentage point, signaling an inverted curve and deterring investors from less liquid, longer-term bonds.

Currently above 5%, the two-year yield is even significantly above the S&P 500’s dividend yield of around 1.6%—the greatest such difference in over 20 years.

Is Consumer Spending Overestimated?

Despite three consecutive favorable inflation reports, the Fed’s guidance shows an expectation to maintain a higher key rate through 2024, with a possible rate hike later this year due to the economy’s surprising resilience. The Treasury Department’s accelerated pace of debt issuance, highlighted by a net raise of $1 trillion through bond sales in the third quarter, is further pressuring the bond market.

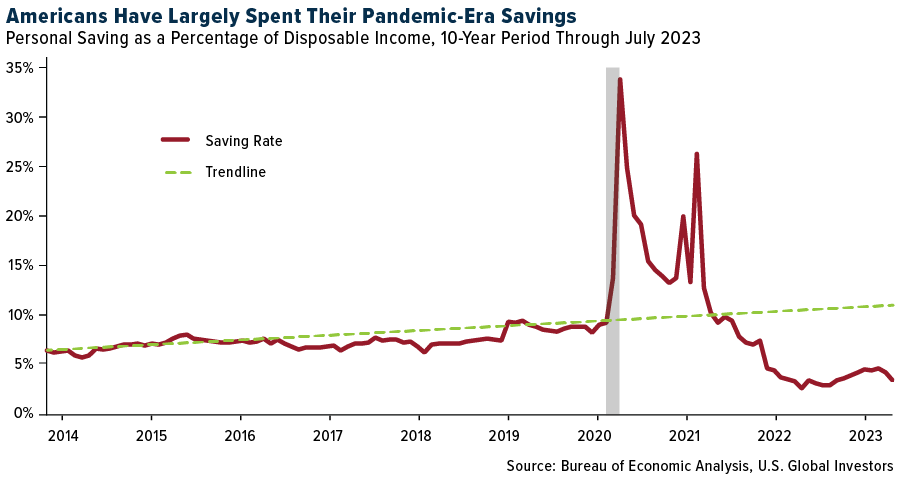

However, I believe that the strength of the U.S. consumer, cited by Fed chair Jerome Powell as the key reason for believing that high rates will only modestly slow down growth, is overestimated. As you can see below, the extensive savings accumulated by households during the early months of the pandemic, which protected the economy against back-to-back rate hikes and an inflationary shock, have been largely spent.

The Quest for Higher Yields

Municipal bonds—debt issued by state and local governments—are likewise yielding more than they have in years, but many investors are flocking to money-market funds and high-yield savings accounts, some of which are offering returns as high as 5.5%, compared to the 3% to 4% yield from the best-rated AAA municipal bonds.

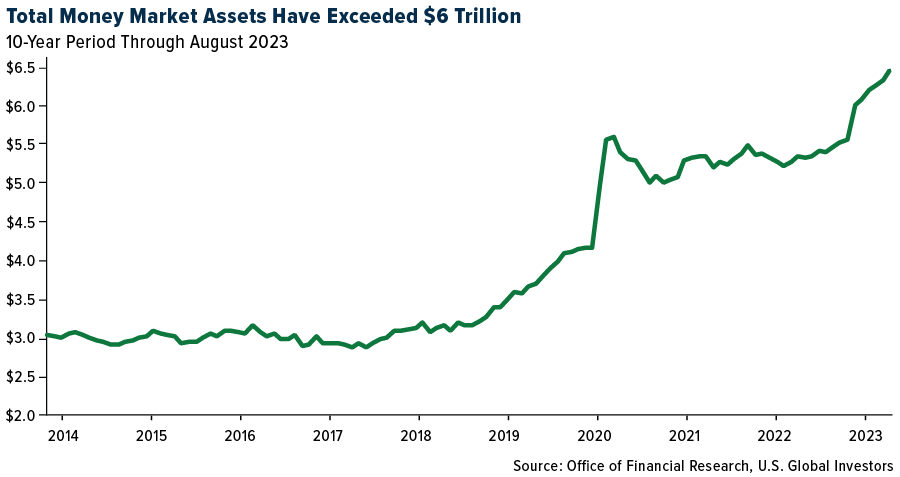

Despite the fact that munis offer income that’s tax-exempt at the federal and often state and local levels, the higher yields in alternative investments continue to divert investors who may be wary of interest-rate risks—even at the cost of potentially missing out on a bond market rally if economic conditions shift and the Fed cuts rates in response. This year, money market funds have attracted some $870 billion in fund flows this year, pushing total assets above a head-spinning $6 trillion for the first time ever.

This shift in preference, driven by the allure of higher yields, has deterred investment in munis—traditional safe havens with tax-free interest benefits. Muni mutual funds, pivotal buyers of state and local debt, have witnessed a stark withdrawal of around $6.2 billion in 2023, contributing to a challenging scenario for boosting performance in the $4 trillion muni-bond market.

NEARX and UGSDX

The selloff in short-term Treasuries and muni bonds, I believe, makes them even more attractive as portfolio diversifiers and potential hedges against equity weakness. As billionaire investor Warren Buffett once said, it’s wise for investors to be fearful when others are greedy and to be greedy only when others are fearful.

We’re pleased to offer two fund options for investors seeking exposure to short-dated government debt.

Near-Term Tax Free Fund (NEARX)

NEARX is focused on investing in municipal bonds that have a relatively short maturity, aiming to offer tax-free monthly income at the federal level and often state and local levels. Under typical market conditions, a minimum of 80% of its net assets are invested in investment-grade municipal securities, which are free from federal income tax, including the federal alternative minimum tax.

Just under 40% of the fund is invested in munis with a maturity of under one year, while approximately 60% is between one and five years.

U.S. Government Securities and Ultra-Short Bond Fund (UGSDX)

UGSDX is designed to invest in U.S. government bonds and obligations while aiming for a higher level of current income compared to what money market funds provide. UGSDX caters to investors who’re interested in capital preservation while earning a potentially higher level of income.

Roughly 87% of the fund is invested in bonds with a maturity of under a year.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes. The Near-Term Tax Free Fund invests at least 80% of its net assets in investment-grade municipal securities. At the time of purchase for the fund’s portfolio, the ratings on the bonds must be one of the four highest ratings by Moody’s Investors Services (Aaa, Aa, A, Baa) or Standard & Poor’s Corporation (AAA, AA, A, BBB). Credit quality designations range from high (AAA to AA) to medium (A to BBB) to low (BB, B, CCC, CC to C). In the event a bond is rated by more than one of the ratings organizations, the highest rating is shown.

The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price. Diversification does not protect an investor from market risks and does not assure a profit. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.